Anti-corruption regulations for promoting socially responsible practices

Associate Professor Srividya Jandhyala, ESSEC Business School, Singapore; Associate Professor Fernando S. Oliveira, Graduate School of Management, University of Auckland

Background

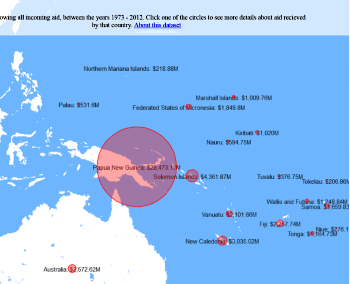

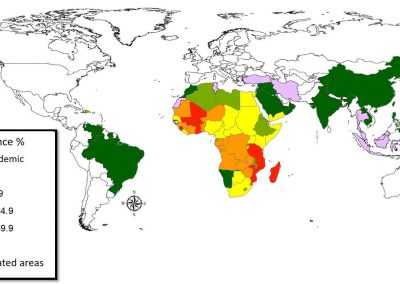

Firms regularly encounter pressure to engage in corrupt and fraudulent practices in the course of their operations, in supply chain management activities, and in procurement auctions. In particular, corruption – the abuse of public power for private gain – is considered to be the norm rather than the exception around the world, and is highly unreported and difficult to track. In recent years, regulatory efforts at tackling corruption have changed in two significant ways. First, international anti-corruption regulations hold firms accountable in their home country for behavior in foreign countries.

Results

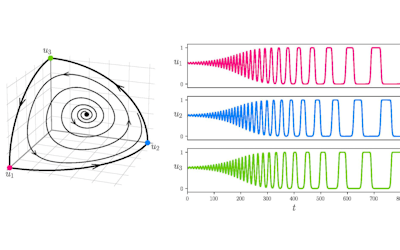

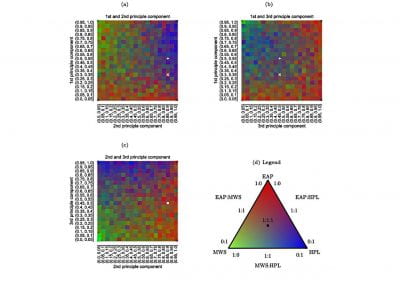

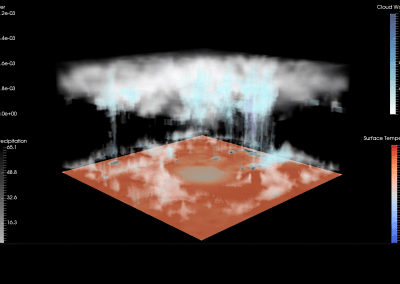

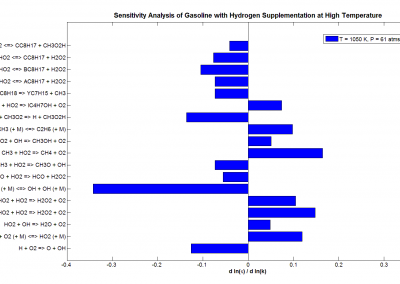

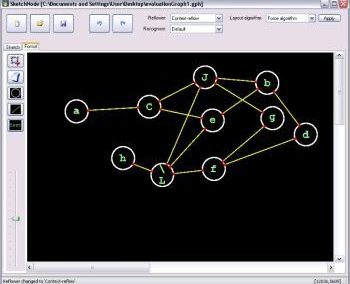

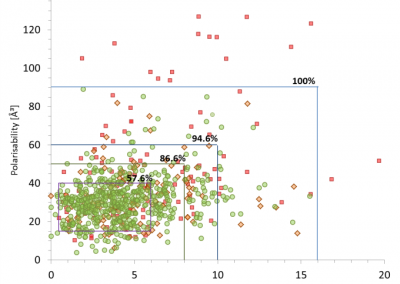

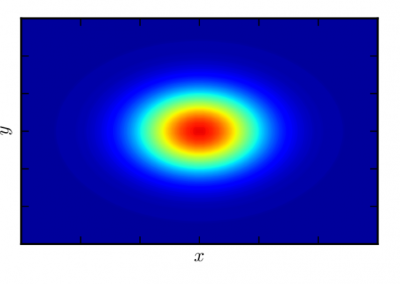

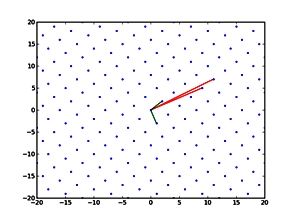

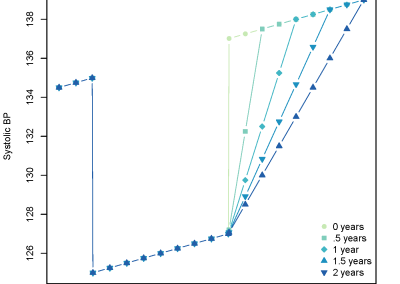

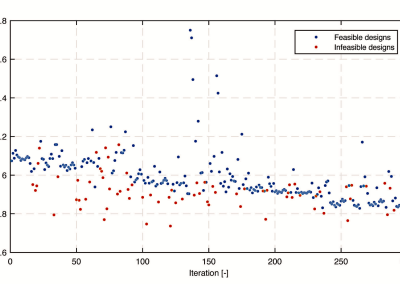

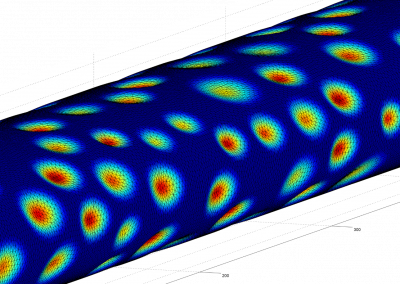

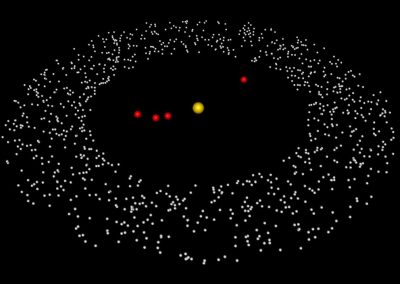

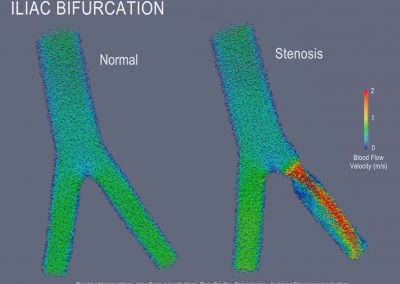

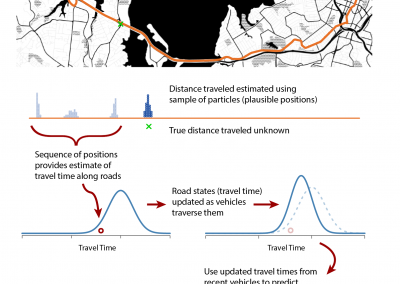

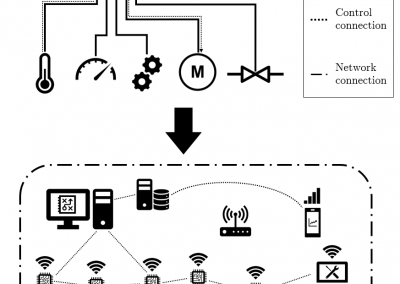

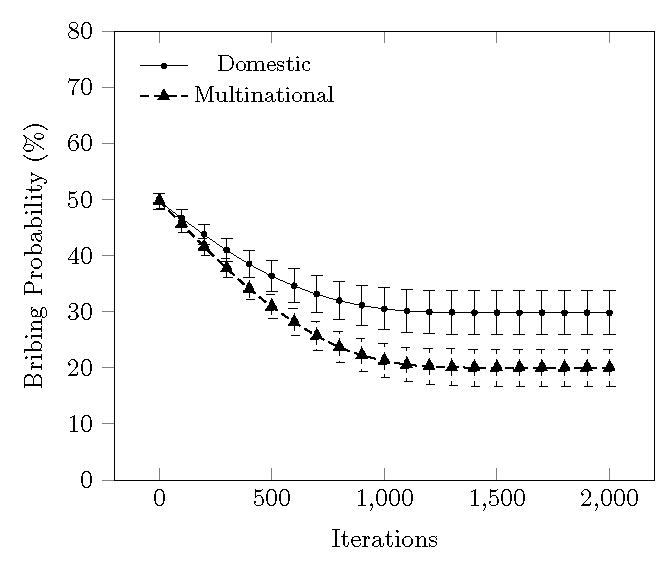

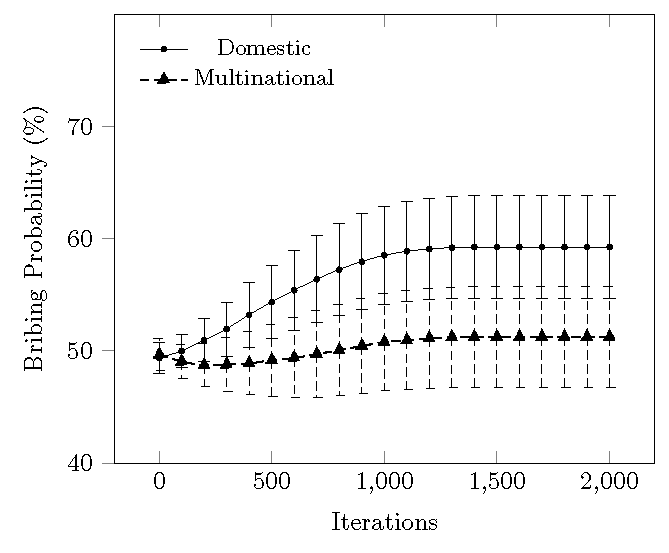

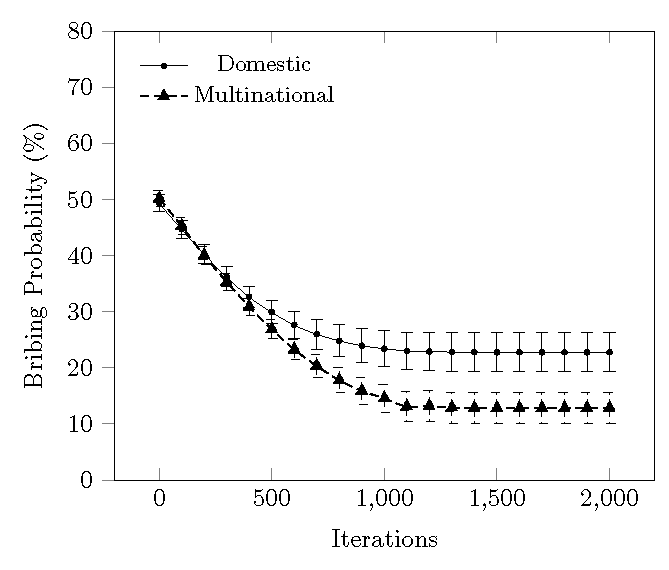

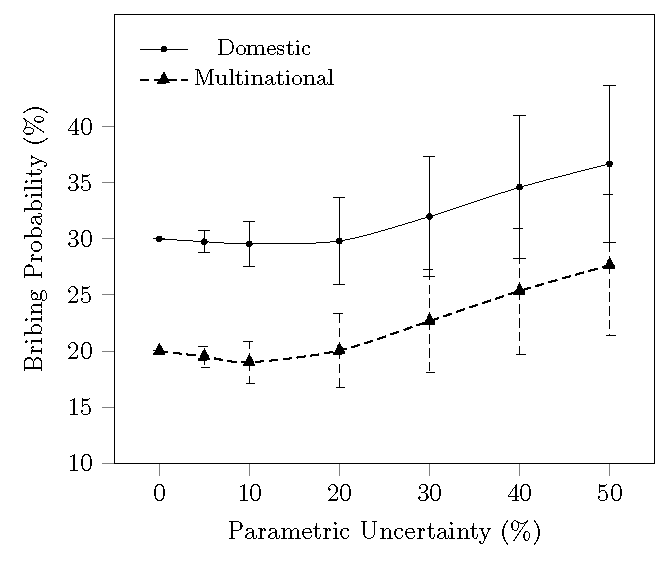

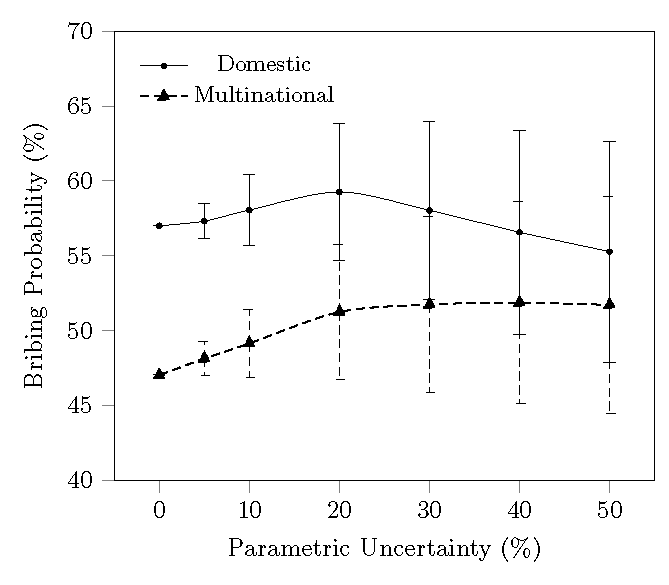

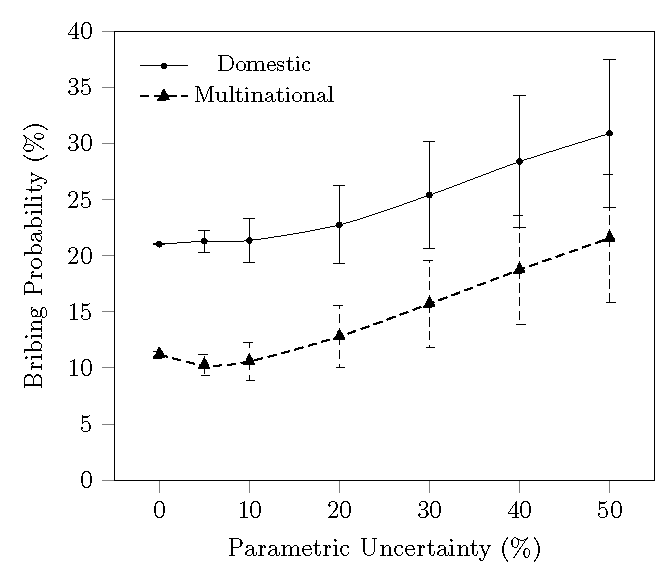

We analyze how firm heterogeneity, within two firm types (domestic and multinational) influences the behavior of the industry and the short and long-term strategies of the firms using an agent-based model, which is able to accommodate firms with different objective functions. The simulation converged to the neighborhood of the Nash equilibrium. In terms of the speed of convergence of the agent-based simulation to the Nash equilibrium it can be faster or slower depending on the prior knowledge of players regarding the optimal strategy.

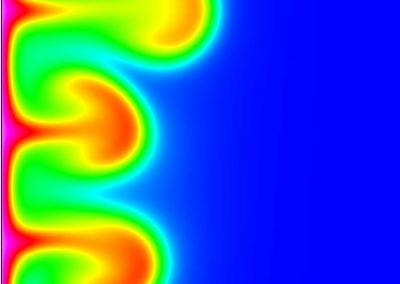

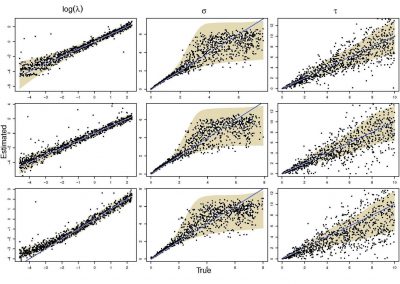

Heterogeneous firms learn the optimal bribing probability.

Impact of parametric uncertainty on the optimal bribing probability.

Conclusions

In particular, in some cases the strategic response of domestic firms may well be to increase their own bribing behavior when competing with multinational firms whose actions are exposed to greater monitoring and sanction through international rules and regulations, even if the overall industry bribing probability declines. Thus, increasing bribe penalties for multinational firms can have an adverse impact on domestic firms’ bribing behavior if they face consistently lower penalties. Better monitoring and increased penalties on multinational firms through international anti-corruption initiatives may be insufficient in constraining bribing behavior.

Acknowledgements

We very gratefully acknowledge the Centre for eResearch, the University of Auckland, for access to the virtual machines.

See more case study projects

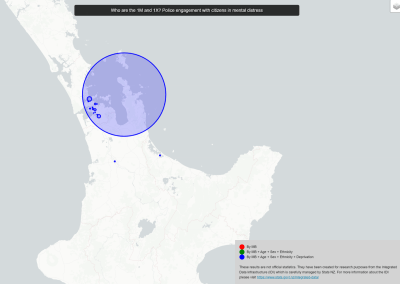

Our Voices: using innovative techniques to collect, analyse and amplify the lived experiences of young people in Aotearoa

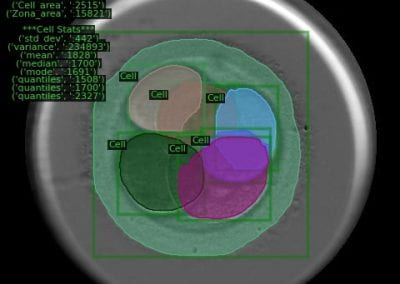

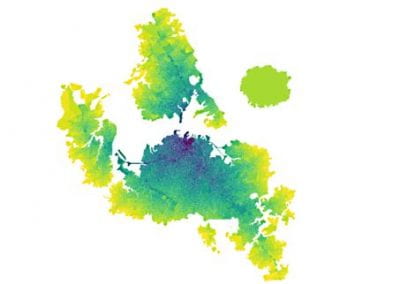

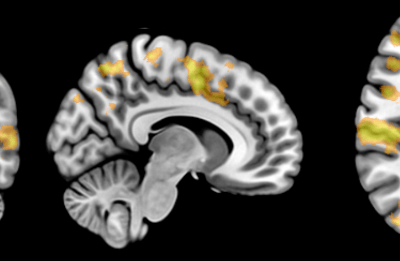

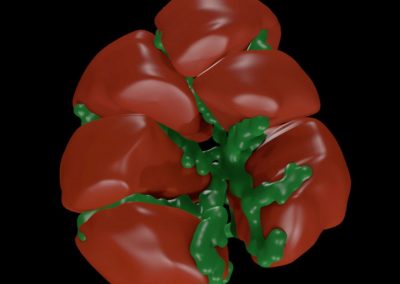

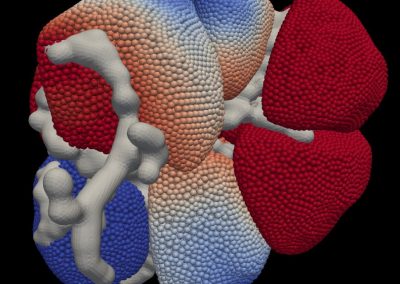

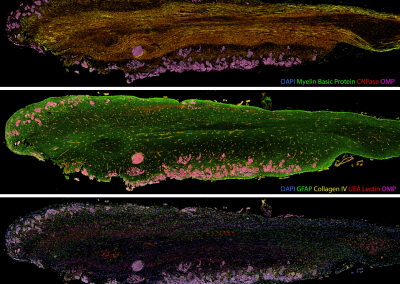

Painting the brain: multiplexed tissue labelling of human brain tissue to facilitate discoveries in neuroanatomy

Detecting anomalous matches in professional sports: a novel approach using advanced anomaly detection techniques

Benefits of linking routine medical records to the GUiNZ longitudinal birth cohort: Childhood injury predictors

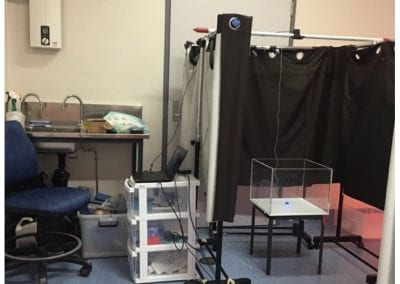

Using a virtual machine-based machine learning algorithm to obtain comprehensive behavioural information in an in vivo Alzheimer’s disease model

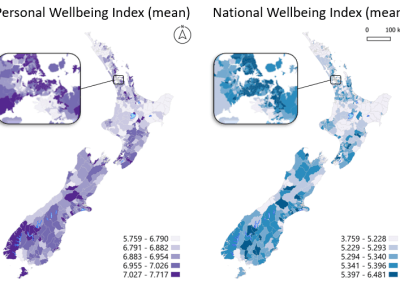

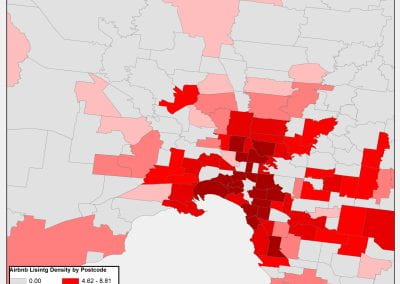

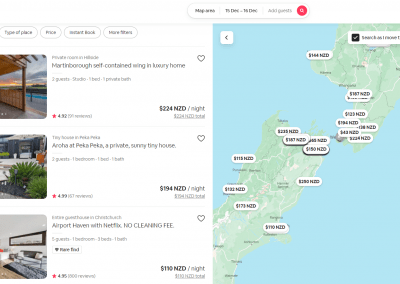

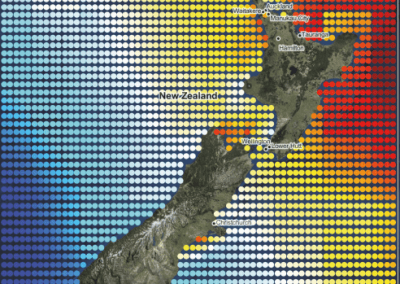

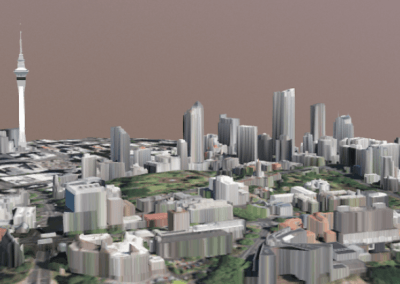

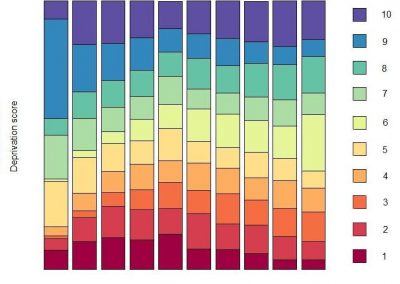

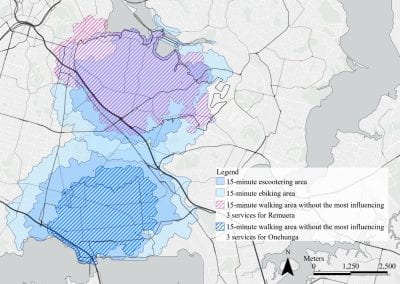

Mapping livability: the “15-minute city” concept for car-dependent districts in Auckland, New Zealand

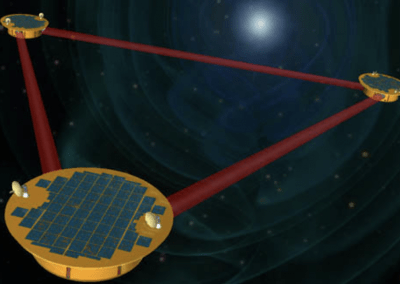

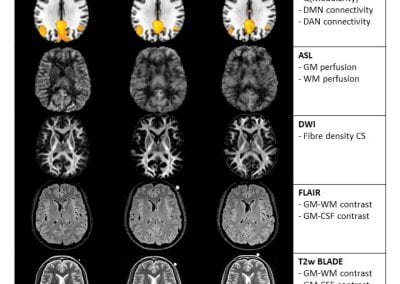

Travelling Heads – Measuring Reproducibility and Repeatability of Magnetic Resonance Imaging in Dementia

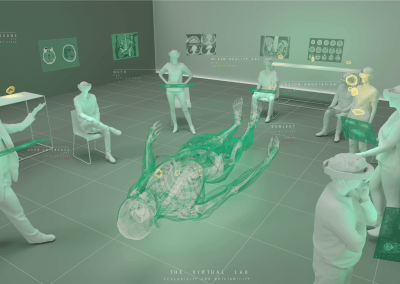

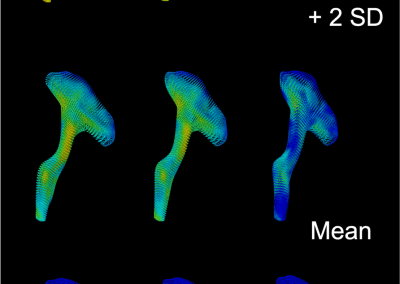

Novel Subject-Specific Method of Visualising Group Differences from Multiple DTI Metrics without Averaging

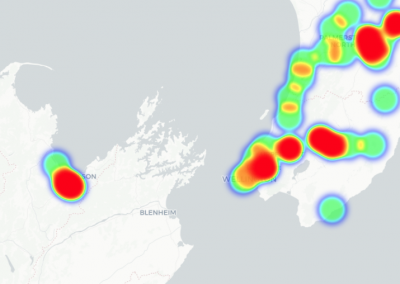

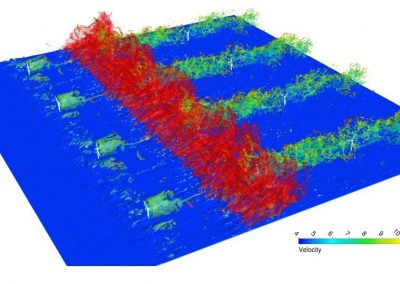

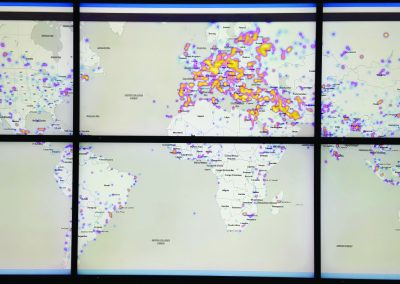

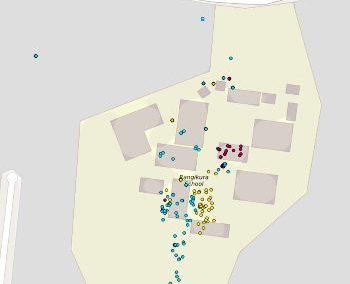

Re-assess urban spaces under COVID-19 impact: sensing Auckland social ‘hotspots’ with mobile location data

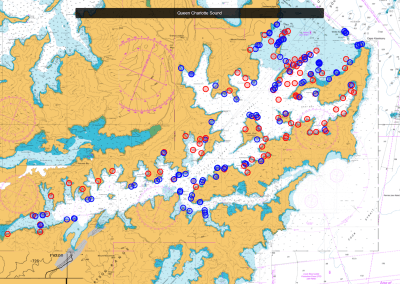

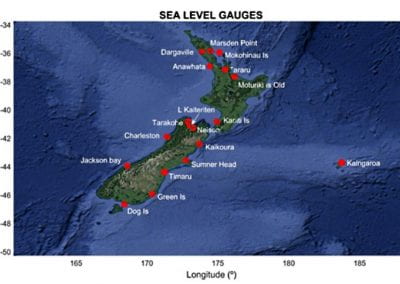

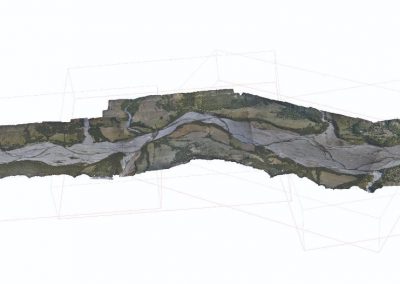

Aotearoa New Zealand’s changing coastline – Resilience to Nature’s Challenges (National Science Challenge)

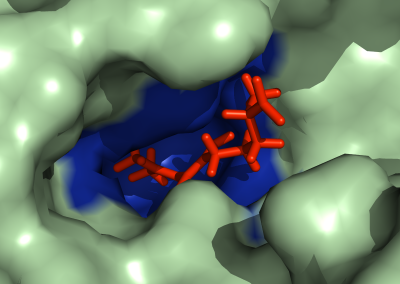

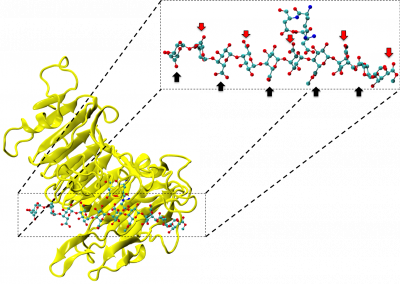

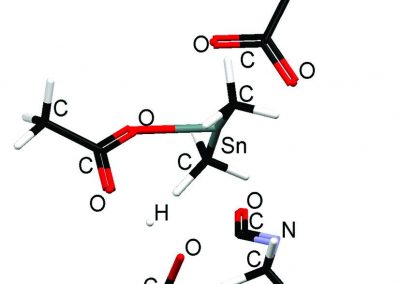

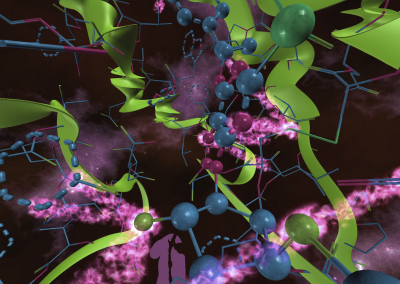

Proteins under a computational microscope: designing in-silico strategies to understand and develop molecular functionalities in Life Sciences and Engineering

Coastal image classification and nalysis based on convolutional neural betworks and pattern recognition

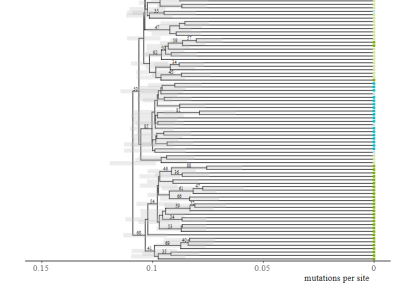

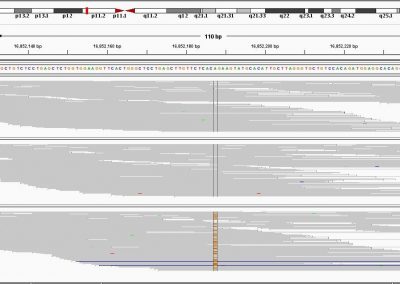

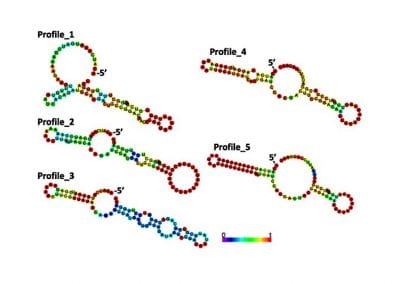

Determinants of translation efficiency in the evolutionarily-divergent protist Trichomonas vaginalis

Measuring impact of entrepreneurship activities on students’ mindset, capabilities and entrepreneurial intentions

Using Zebra Finch data and deep learning classification to identify individual bird calls from audio recordings

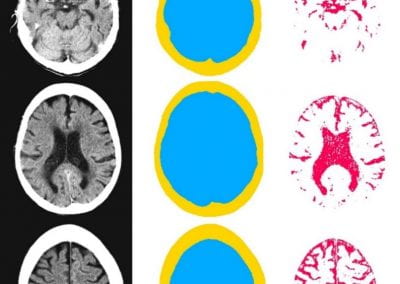

Automated measurement of intracranial cerebrospinal fluid volume and outcome after endovascular thrombectomy for ischemic stroke

Using simple models to explore complex dynamics: A case study of macomona liliana (wedge-shell) and nutrient variations

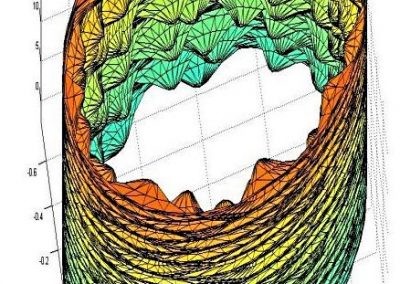

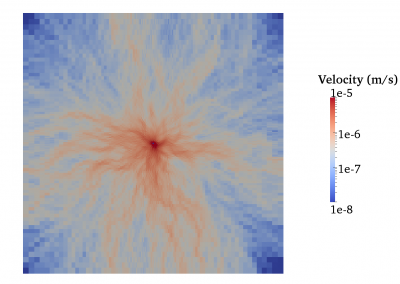

Fully coupled thermo-hydro-mechanical modelling of permeability enhancement by the finite element method

Modelling dual reflux pressure swing adsorption (DR-PSA) units for gas separation in natural gas processing

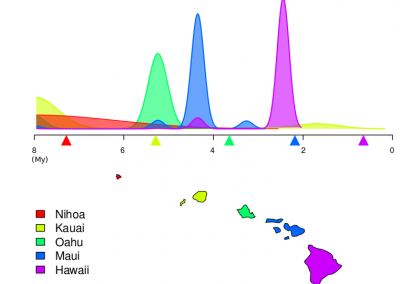

Molecular phylogenetics uses genetic data to reconstruct the evolutionary history of individuals, populations or species

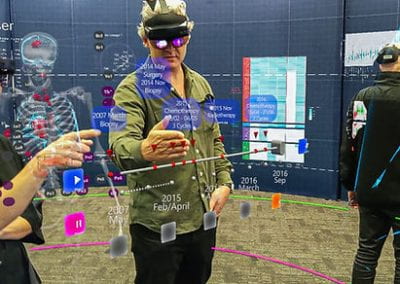

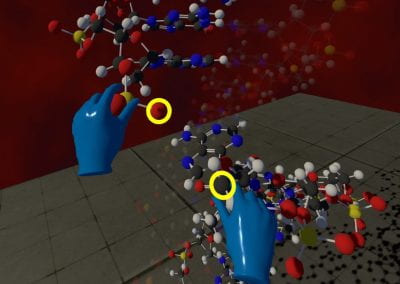

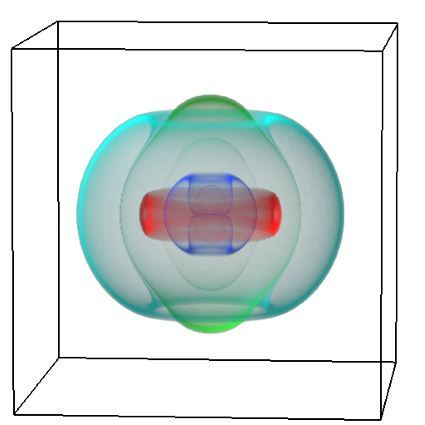

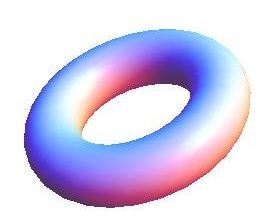

Wandering around the molecular landscape: embracing virtual reality as a research showcasing outreach and teaching tool