Detecting anomalous matches in professional sports: a novel approach using advanced anomaly detection techniques

Dr Dulani Jayasuriya, Business and Economy, Business School; Mohamed Ayaz, PhD candidate, Department of Civil and Environmental Engineering; Michael Williams, PricewaterhouseCoopers, Auckland, New Zealand

Abstract

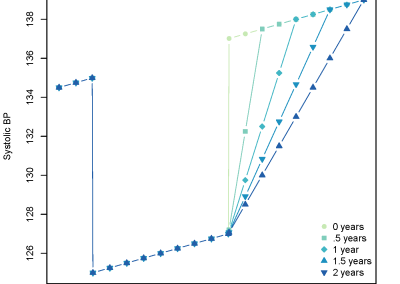

This study investigates the increasing use of digital footprints (DFs) by lenders in the U.S. residential mortgage market. From 2013 to 2018, the proportion of lenders utilizing borrowers’ DFs rose significantly from 6% to 34%. The research demonstrates that DFs can considerably reduce lenders’ overall risk and mitigate discriminatory lending practices, providing a substantial informational advantage over traditional lending methods.

Introduction

With the rapid growth of the Internet, the utilization of collected data, including digital footprints (DFs), has become a critical issue in academic and political debates. This study is set against the backdrop of increasing internet usage, where an estimated 89% of American adults are active online. The research aims to explore the role of DFs in the financial sector, particularly in the U.S. residential mortgage market, where FinTech lenders have been at the forefront of incorporating technology into the loan approval process.

Contribution to literature

The research contributes to various areas, including FinTech lending, shadow banking, financial intermediaries, information asymmetry, consumer behavior prediction, residential mortgages, and discriminatory lending. It is the first study to focus specifically on the impact of DF users on riskiness, discriminatory lending, and borrower characteristics in the U.S. residential mortgage market.

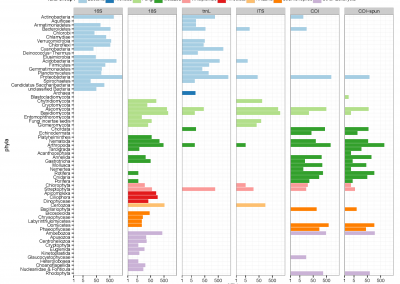

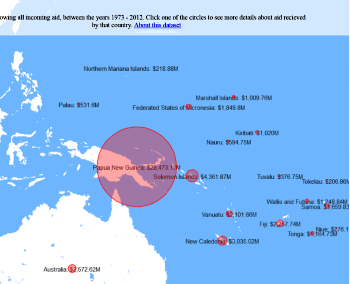

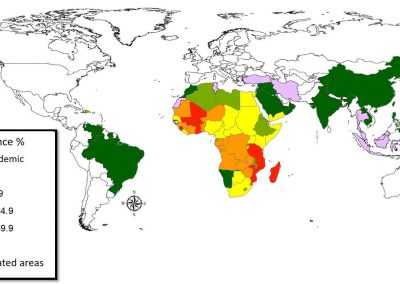

Number of DF users in US residential mortgage market.

References:

Fuster, A., Plosser, M.C., Schnabl, P. & Vickery, J.I. (2019) The role of technology in mortgage lending. The Review of Financial Studies, 32(5), 1854–1899. Available from: https://doi.org/10.1093/rfs/hhz018

A news article also published in the University regarding this research work. website. https://www.auckland.ac.nz/en/news/2022/08/08/getting-personal–how-digital-footprints-are-changing-the-mortga.html

See more case study projects

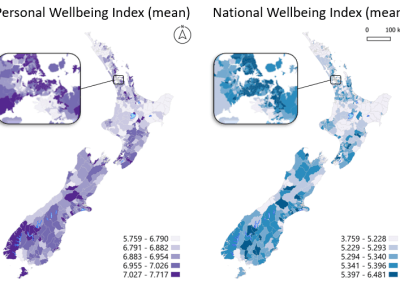

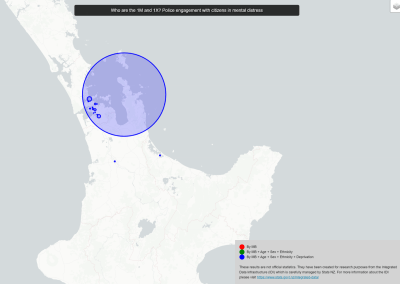

Our Voices: using innovative techniques to collect, analyse and amplify the lived experiences of young people in Aotearoa

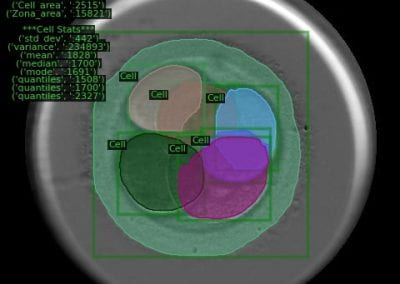

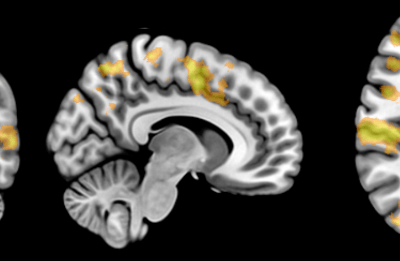

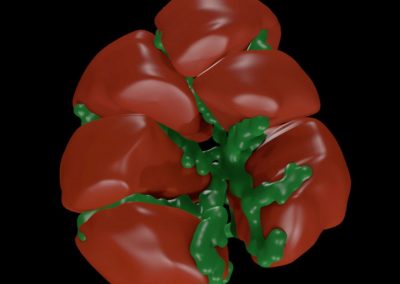

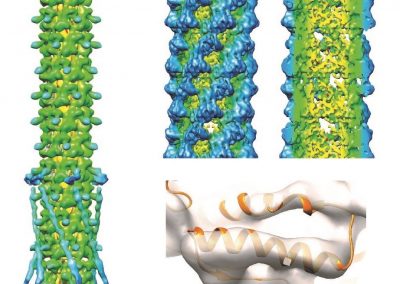

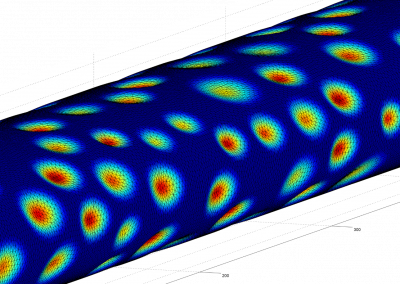

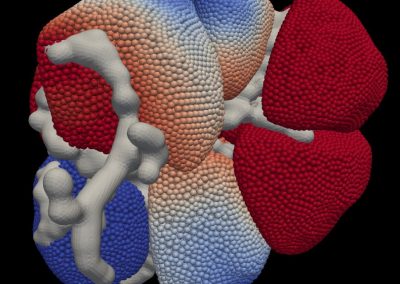

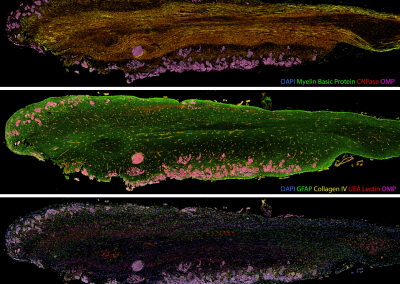

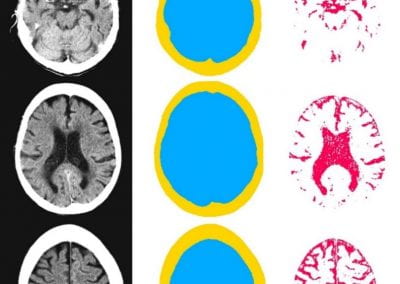

Painting the brain: multiplexed tissue labelling of human brain tissue to facilitate discoveries in neuroanatomy

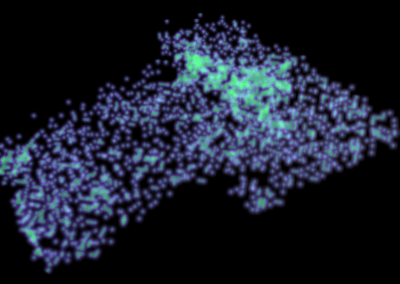

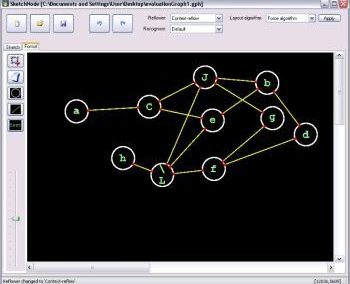

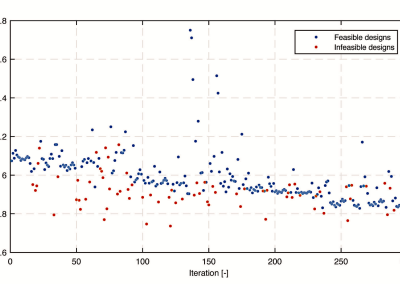

Detecting anomalous matches in professional sports: a novel approach using advanced anomaly detection techniques

Benefits of linking routine medical records to the GUiNZ longitudinal birth cohort: Childhood injury predictors

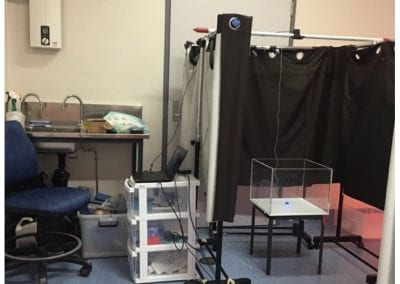

Using a virtual machine-based machine learning algorithm to obtain comprehensive behavioural information in an in vivo Alzheimer’s disease model

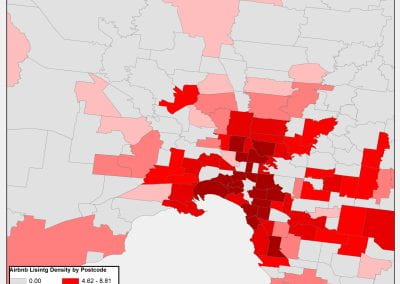

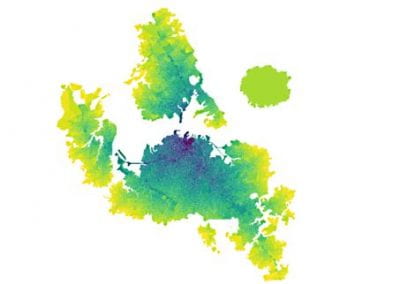

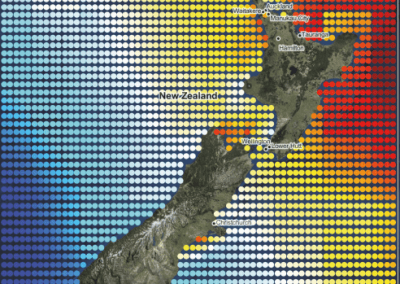

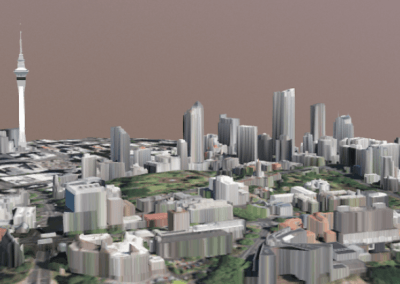

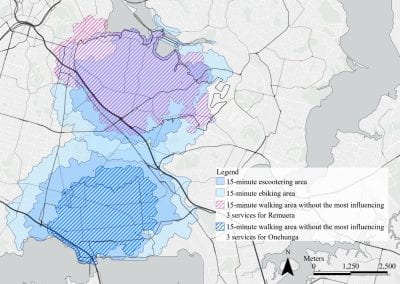

Mapping livability: the “15-minute city” concept for car-dependent districts in Auckland, New Zealand

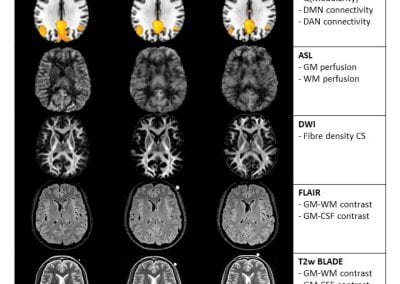

Travelling Heads – Measuring Reproducibility and Repeatability of Magnetic Resonance Imaging in Dementia

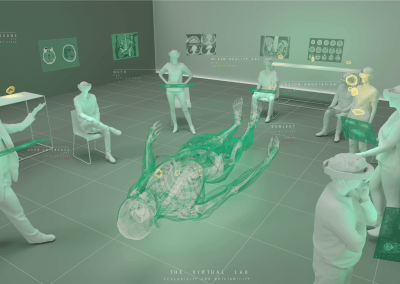

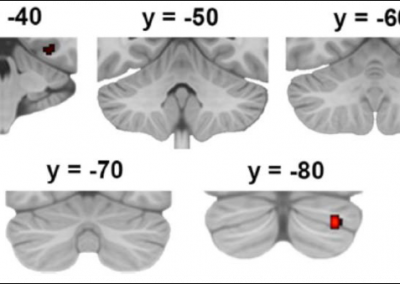

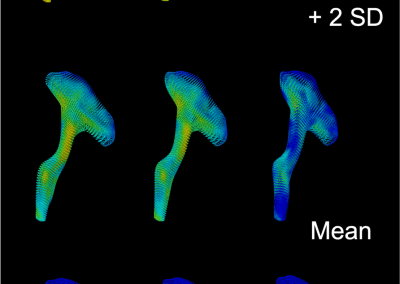

Novel Subject-Specific Method of Visualising Group Differences from Multiple DTI Metrics without Averaging

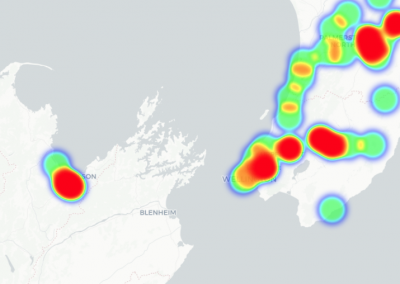

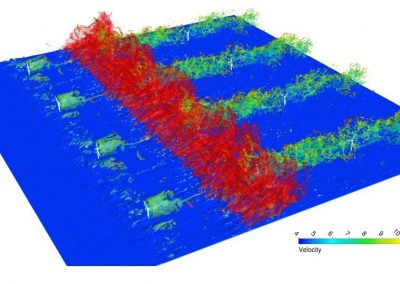

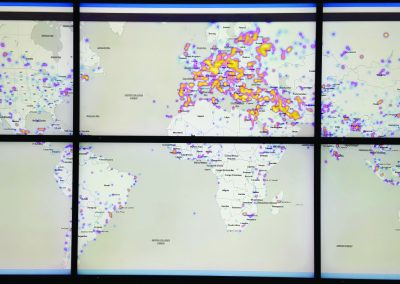

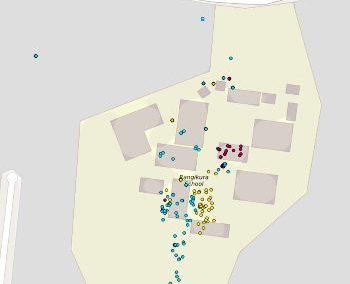

Re-assess urban spaces under COVID-19 impact: sensing Auckland social ‘hotspots’ with mobile location data

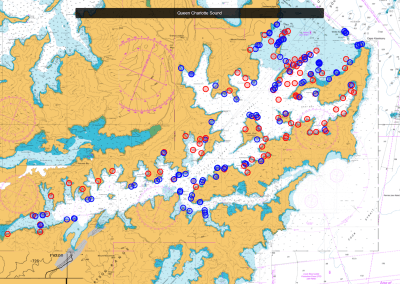

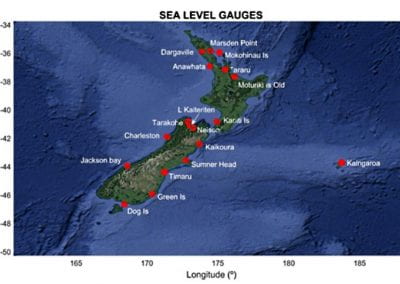

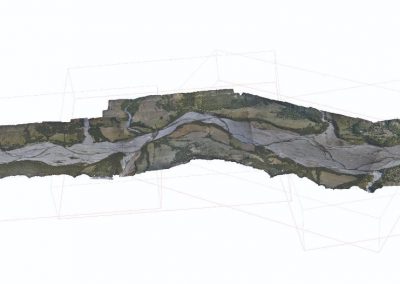

Aotearoa New Zealand’s changing coastline – Resilience to Nature’s Challenges (National Science Challenge)

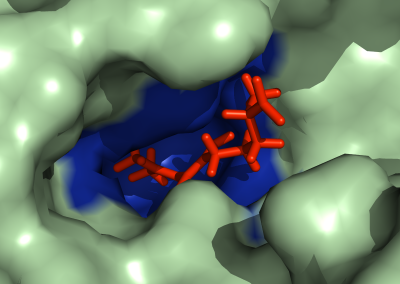

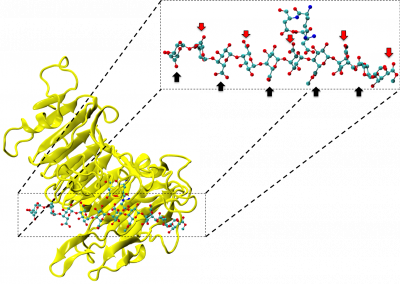

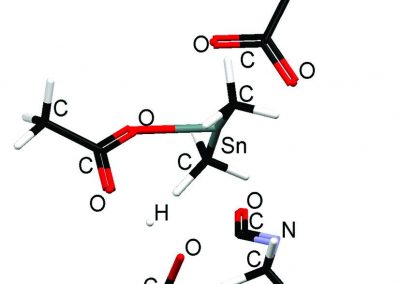

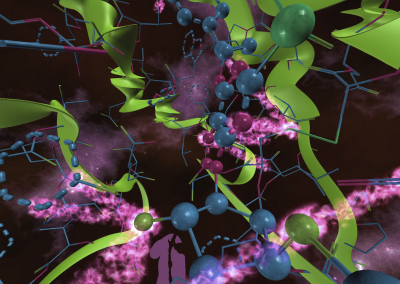

Proteins under a computational microscope: designing in-silico strategies to understand and develop molecular functionalities in Life Sciences and Engineering

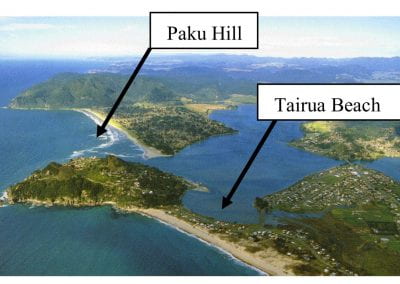

Coastal image classification and nalysis based on convolutional neural betworks and pattern recognition

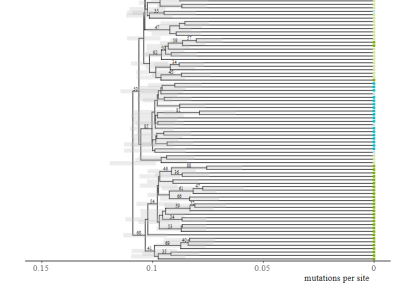

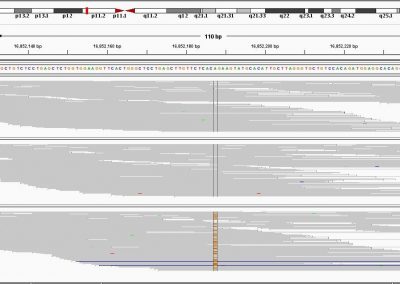

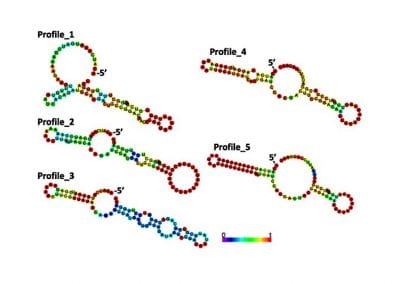

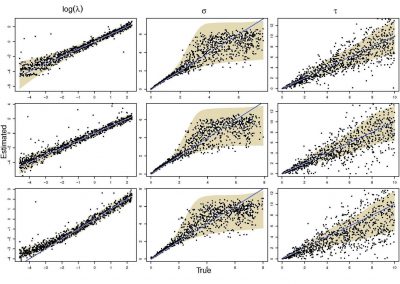

Determinants of translation efficiency in the evolutionarily-divergent protist Trichomonas vaginalis

Measuring impact of entrepreneurship activities on students’ mindset, capabilities and entrepreneurial intentions

Using Zebra Finch data and deep learning classification to identify individual bird calls from audio recordings

Automated measurement of intracranial cerebrospinal fluid volume and outcome after endovascular thrombectomy for ischemic stroke

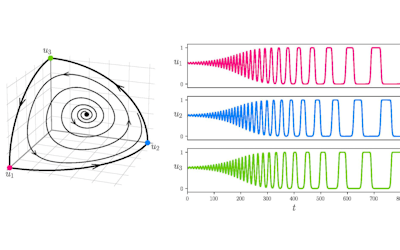

Using simple models to explore complex dynamics: A case study of macomona liliana (wedge-shell) and nutrient variations

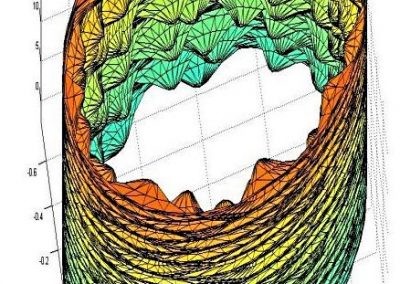

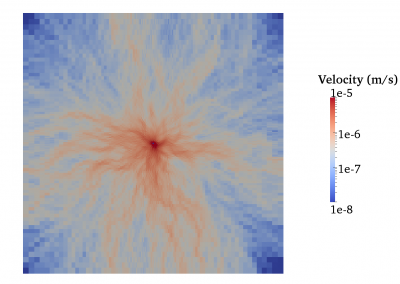

Fully coupled thermo-hydro-mechanical modelling of permeability enhancement by the finite element method

Modelling dual reflux pressure swing adsorption (DR-PSA) units for gas separation in natural gas processing

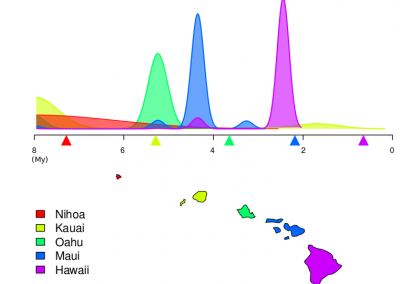

Molecular phylogenetics uses genetic data to reconstruct the evolutionary history of individuals, populations or species

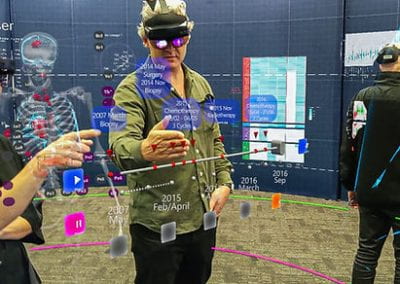

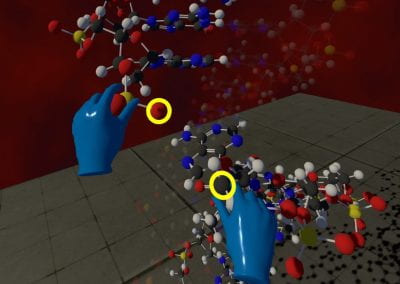

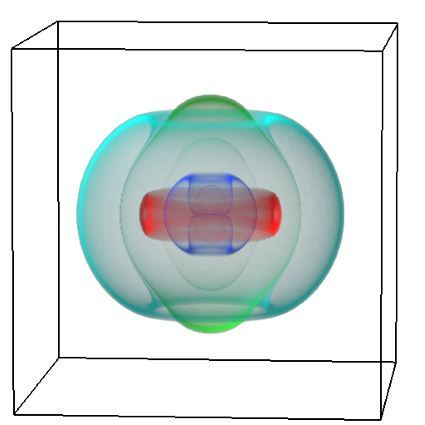

Wandering around the molecular landscape: embracing virtual reality as a research showcasing outreach and teaching tool